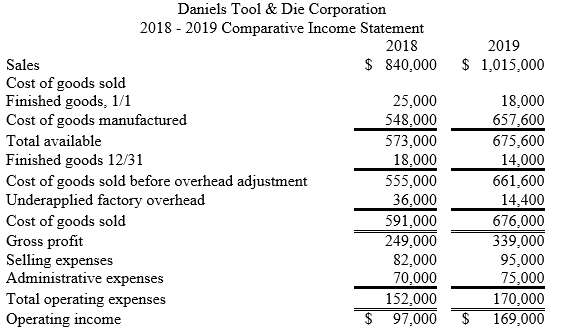

The Daniels Tool & Die Corporation has been in existence for a little over three years; its sales have been increasing each year as it has built a reputation. The company manufactures dies to its customers' specifications; as a consequence, a job order cost system is employed. Factory overhead is applied to the jobs based on direct labor hours. Actual variable overhead is the same as applied variable overhead. Overapplied or underapplied overhead is treated as an adjustment to cost of goods sold. The company's income statements for the last two years are presented below. Daniels used the same predetermined overhead rate in applying overhead to production orders in both 2018 and 2019. The rate was based on the following estimates:

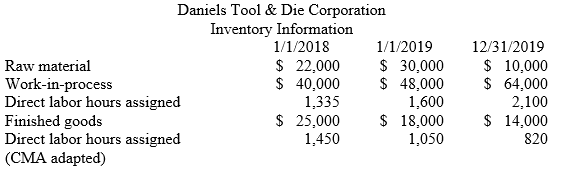

Daniels used the same predetermined overhead rate in applying overhead to production orders in both 2018 and 2019. The rate was based on the following estimates:

In 2018 and 2019, actual direct labor hours expended were 20,000 and 23,000, respectively. Raw materials put into production were $292,000 in 2018 and $370,000 in 2019. Actual fixed overhead was $42,300 for 2018 and $37,400 for 2019, and the planned direct labor rate was the direct labor rate achieved.

For both years, all of the reported administrative costs were fixed, while the variable portion of the reported selling expenses result from a commission of five percent of sales revenue. Required:

Required:

(1) For the year December 31, 2019, prepare a revised income statement for Daniels Tool & Die Corporation utilizing the variable costing method.

(2) Prepare a numerical reconciliation of the difference in operating income between Daniels Tool & Die Corporation's costing and the revised 2019 income statement prepared on the basis of variable costing.

(3) Describe both the advantages and disadvantages of using variable costing.

Correct Answer:

Verified

Fixed overhead...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q120: A value stream is:

A) A set of

Q121: Red Apple Industries manufactures institutional-use furniture. Dept.

Q122: Doctors Health Care System has integrated health

Q123: Fitzpatrick Inc. planned and manufactured 500,000 units

Q124: Stultz Manufacturing has the following information

Q125: Brantley Inc. manufactures calculators that sell

Q126: Divisional managers of SIU Incorporated have been

Q127: Lawson Company had the following manufacturing information

Q128: Chadd Fisher was recently appointed vice president

Q129: A model that has been used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents