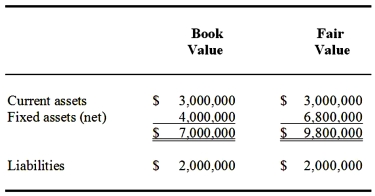

Ford Corporation paid $10,200,000 for a 47% interest in Allen Corporation on January 1,2014 when Allen had the following identifiable assets and liabilities:

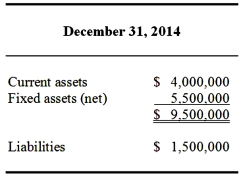

At the time of Ford's purchase,the fixed assets had a remaining life of 8 years.For the year ended December 31,2014,Allen reported sales of $9 million and expenses of $5 million and declared and paid dividends of $1 million.At December 31,2014,Allen reported the following balance sheet information:

Required:

1.Give the income statement and balance sheet accounts and amounts as they would appear on Ford's financial statements under the equity method for the year ended December 31,2014.Be sure to show calculations.

2.Explain how your answer to requirement 'a' would change if Ford determined that it actually controlled Allen and had to consolidate its investment.Give specific income statement and balance sheet accounts and amounts where possible.Be sure to show calculations.

Correct Answer:

Verified

2. Instead o...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q120: Which of the following criteria is applicable

Q121: Mercedes Company paid $20,000,000 to purchase 100%

Q122: The difference between the amortized cost basis

Q123: Other-than-temporary impairments are not an issue for

Q124: Beemer Company has provided the following information

Q125: The Kruk Company regularly sells merchandise to

Q126: For available-for-sale debt securities,if a firm intends

Q127: Sub Company is a 100% owned subsidiary

Q128: On January 2,2015,the Rambler Company purchased 40%

Q129: The Collins Company paid $1,050,000 to purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents