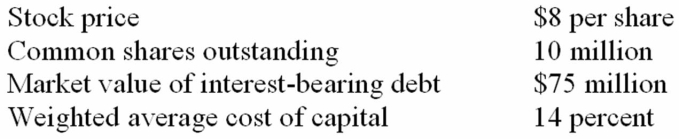

The following information is available about Chiantivino Corp.(CC):

An activist investor is confident that by terminating CC's money-losing fortified wine division,she can increase free cash flow by $4 million annually for the next decade.In addition,she estimates that an immediate,special dividend of $10 million can be financed by the sale of the division.

An activist investor is confident that by terminating CC's money-losing fortified wine division,she can increase free cash flow by $4 million annually for the next decade.In addition,she estimates that an immediate,special dividend of $10 million can be financed by the sale of the division.

a.Assuming these actions do not affect CC's cost of capital,what is the maximum price per share the investor would be justified in bidding for control of CC?

What percentage premium does this represent?

b.Show your answer if you conduct a sensitivity analysis by assuming the cost of capital is 15 percent and the increased cash flow is only $3.5 million per year.

Correct Answer:

Verified

Q1: Estimate BSL's value (in $ millions)at the

Q2: Ginormous Oil entered into an agreement to

Q4: Estimate the present value of BSL's free

Q5: Which of the following statements are correct?

I.Liquidation

Q6: Below is a recent income statement for

Q7: Which of the following statements are correct?

I.Going-concern

Q8: The following table presents forecasted financial and

Q9: Ginormous Oil entered into an agreement to

Q10: Which of the following statements is/are correct?

I.Going-concern

Q11: Assume that in the years after 2015

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents