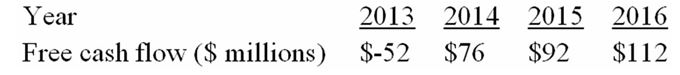

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value of Kenmore Air at the end of 2012.Assume that after 2016,earnings before interest and tax will remain constant at $200 million,depreciation will equal capital expenditures in each year,and working capital will not change.Kenmore Air's weighted-average cost of capital is 11 percent and its tax rate is 40 percent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Estimate BSL's value (in $ millions)at the

Q17: Consider the following premerger information about a

Q18: The following table presents forecasted financial and

Q19: The following table presents forecasted financial and

Q20: Assume BSL is worth the book value

Q23: The following table presents a four-year forecast

Q24: Ametek,Inc.is a billion dollar manufacturer of electronic

Q26: The following table presents a four-year forecast

Q28: Rainy City Coffee's (RCC)free cash flow next

Q36: Empirical evidence indicates that the returns to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents