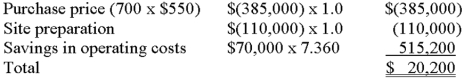

Harrison Township is studying a 700-acre site for a new landfill.The new site will save $70,000 in annual operating costs for 10 years,as Harrison currently uses the landfill of a neighboring municipality.Other data are:

Purchase price per acre: $550

Site preparation costs: $110,000

Hurdle rate: 6%

Ignore income taxes.

Required:

A.

Yes,the landfill should be acquired because it has a positive net present value.

A.Use the net-present-value method and determine whether the landfill should be acquired.

B.Determine the landfill's approximate internal rate of return.

B.Let X = present value factor

$70,000X = ($385,000 + $110,000)

X = 7.071

A review of annuity factors for 10 years finds an internal rate of return that falls between 6% (7.360)and 8% (6.710).

Correct Answer:

Verified

Yes,the landfill should be acquired...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Wornell Industries is currently purchasing part no.

Q91: Consider the five items that follow, which

Q99: Porschia is considering the acquisition of new

Q100: Wrikeman evaluates future projects by using the

Q102: Schille Company is considering a $5.4 million

Q103: An increased number of companies are investing

Q105: Depreciation is often described as a "tax

Q107: Both net present value (NPV)and the internal

Q108: Lasley Corporation is considering the acquisition of

Q109: Wexford Corporation is considering the acquisition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents