Wexford Corporation is considering the acquisition of a new machine that costs $350,000.The machine is expected to have a four-year service life and will produce annual savings in cash operating costs of $100,000.Wexford uses the optional straight-line method of depreciation and depreciates the asset over its four-year service life.The company is subject to a 30% income tax rate,has an after-tax hurdle rate of 12%,and rounds calculations to the nearest dollar.

Required:

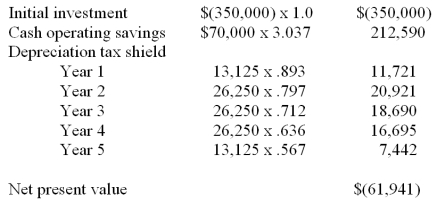

A.Annual cash operating costs: $(100,000)* 0.7 = $(70,000)

Depreciation tax savings:

Year 1: $43,750 x .3 = 13,125

Year 2: $87,500 x .3 = 26,250

Year 3: $87,500 x .3 = 26,250

Year 4: $87,500 x .3 = 26,250

Year 5: $43,750 x .3 = 13,125

A.Determine the annual after-tax cash flows that result from acquisition of the machine.

B.

The machine is not considered an attractive investment because it has a negative net present value.

B.Calculate the machine's Net present value.Is the machine an attractive investment? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Wornell Industries is currently purchasing part no.

Q89: Mark Industries is currently purchasing part no.

Q104: Harrison Township is studying a 700-acre site

Q105: Depreciation is often described as a "tax

Q107: Both net present value (NPV)and the internal

Q108: Lasley Corporation is considering the acquisition of

Q110: Custom Plastics plans to purchase $4.5 million

Q111: The Warren Machine Tool Company is considering

Q112: On January 2,20x1,Rebecca Brown purchased 800 shares

Q113: A profitability index can be used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents