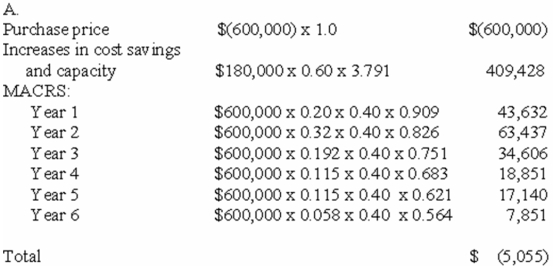

The Warren Machine Tool Company is considering the addition of a computerized lathe to its equipment inventory.The initial cost of the equipment is $600,000,and the lathe is expected to have a useful life of five years and no salvage value.The cost savings and increased capacity attributable to the machine are estimated to generate increases in the firm's annual cash inflows (before considering depreciation)of $180,000.The machine will be depreciated using MACRS for tax purposes.The 5-year MACRS depreciation percentages as computed by the IRS are: Year 1 = 20.00%;Year 2 = 32.00%;Year 3 = 19.20%;Year 4 = 11.52%;Year 5 = 11.52%;Year 6 = 5.76%.

Warren is currently in the 40% income tax bracket.A 10% after-tax rate of return is desired.

Required:

A.What is the net present value of the investment? Round to the nearest dollar.

B.No,the machine should not be acquired because it has a negative net present value.

B.Should the machine be acquired by the firm?

C.

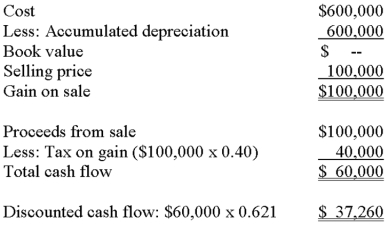

The net present value will increase by $37,260.In this case,the machine should be acquired because it has a positive net present value.

C.Assume that the equipment will be sold at the end of its useful life for $100,000.If the depreciation amounts are not revised,calculate the dollar impact of this change on the total net present valuE.

Correct Answer:

Verified

B.No,the machine should not be acquire...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Wornell Industries is currently purchasing part no.

Q89: Mark Industries is currently purchasing part no.

Q104: Harrison Township is studying a 700-acre site

Q105: Depreciation is often described as a "tax

Q107: Both net present value (NPV)and the internal

Q108: Lasley Corporation is considering the acquisition of

Q109: Wexford Corporation is considering the acquisition of

Q110: Custom Plastics plans to purchase $4.5 million

Q112: On January 2,20x1,Rebecca Brown purchased 800 shares

Q113: A profitability index can be used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents