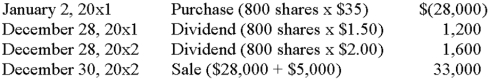

On January 2,20x1,Rebecca Brown purchased 800 shares of Bazooka Telecommunications common stock at $35 per share.The company paid a $1.50 dividend per share on December 28 of that year,and raised the amount by $0.50 per share for a distribution on December 28,20x2.Rebecca sold her entire investment on December 30,20x2,generating a $5,000 gain on the sale of stock.

Required:

A.

A.Prepare a dated listing of the cash inflows and outflows related to Rebecca's stock investment.Ignore income taxes.

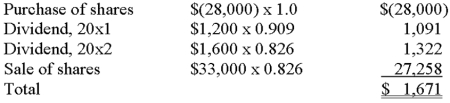

B.Assume that Rebecca has a 10% hurdle rate for all investments.Rounding to the nearest dollar,compute the net present value of her investment in Bazooka and determine whether she achieved her 10% goal.

B.Rebecca achieved her goal,as indicated by the positive net present value.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Wornell Industries is currently purchasing part no.

Q89: Mark Industries is currently purchasing part no.

Q104: Harrison Township is studying a 700-acre site

Q105: Depreciation is often described as a "tax

Q107: Both net present value (NPV)and the internal

Q108: Lasley Corporation is considering the acquisition of

Q109: Wexford Corporation is considering the acquisition of

Q110: Custom Plastics plans to purchase $4.5 million

Q111: The Warren Machine Tool Company is considering

Q113: A profitability index can be used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents