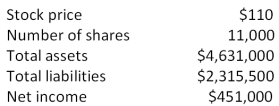

The Metallica Heavy Metal Mining (MHMM) Corporation wants to diversify its operations. Some recent financial information for the company is shown here:  MHMM is considering an investment that has the same P/E ratio as the firm. The cost of the investment is $798,270, and it will be financed with a new equity issue. What would the ROE on the investment have to be if we wanted the price after the offering to be $110 per share?

MHMM is considering an investment that has the same P/E ratio as the firm. The cost of the investment is $798,270, and it will be financed with a new equity issue. What would the ROE on the investment have to be if we wanted the price after the offering to be $110 per share?

Assume the PE ratio remains constant.

A) 18.28 percent

B) 21.41 percent

C) 27.63 percent

D) 37.27 percent

E) 40.03 percent

Correct Answer:

Verified

Q73: The Timken Company has announced a rights

Q81: The Educated Horses Corporation needs to raise

Q83: Mountain Homes wishes to expand its facilities.The

Q84: The Woods Co.and the Mickelson Co.have both

Q84: Flagler, Inc. needs to raise $30 million

Q85: The Huff Co. has just gone public.

Q86: Atlas Corp. wants to raise $4 million

Q87: Steve is the founder of Jefferson &

Q87: The Warm Shoe Co. has concluded that

Q93: Precise Machining is considering a rights offer.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents