Angela Smith has owned and operated The Stationary Store for fifteen years.The company's year-end is December 31st.Angela is trying to calculate the amount of capital cost allowance that she can deduct in 20x0 and has asked for your assistance.She has provided you with the following information:

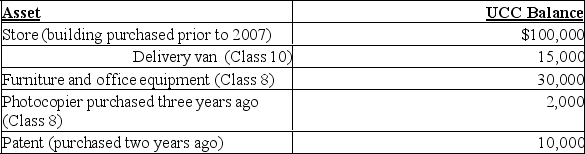

Assets owned prior to 20x0 and their UCC balances on January 1,20x0 are listed below:

Additional information for 20x0:

Additional information for 20x0:

Angela purchased $2,000 worth of small tools (each costing under $500).

She sold her delivery van for $12,000 (the original cost was $20,000),and she purchased a second-hand van for $16,000.

She installed a $15,000 air conditioning system in her building and added the cost to the standard Class 1 pool.

In December of 20x0 she sold the photocopier for $1,500 and will replace it in January,20x1 with a second-hand model valued at $1,700.

Angela amortizes the patent in Class 44.

The business acquired a franchise on March 1st of 20x0 costing $55,000.The franchise has a limited legal life of 20 years.(Ignore leap year effects.)

Required:

A)Calculate the following:

1)the total CCA that Angela will be able to claim in 20x0;

2)the UCC balances as of December 31,20x0;

3)any recapture and/or terminal loss that occurred during the year.

B)What would the tax effect have been for the original photocopier if Angela had purchased the new photocopier during 20x0?

Correct Answer:

Verified

Q3: (Adapted from "Problem Eleven" from Chapter Six

Q4: Green Business Ltd.(GBL)began operating ten years ago,and

Q4: Which of the following statements regarding recapture

Q4: ABC Corp. leased an office and paid

Q6: Which of the following situations would not

Q6: Which of the following cases is not

Q7: Tom's Tool Rentals began operations in 20x0.All

Q9: Green Gardens Inc.purchased a piece of Class

Q10: Ben incorporated Miller Co.in 20x7,which then purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents