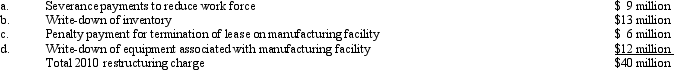

Penny Corp.manufactures telecommunication equipment and has been profitable each year for the past ten years.During 2010 the company saw its core market decline sharply when a competitor introduced a significant new product technology.In response to the decline in business Penny Corp.announced a major restructuring of its operations.The restructuring plan which would be implemented in 2010 would involve the following changes (all of the charges are material):

Penny Corp.has never previously restructured its operations and believes that it can return to profitability within two years based on its current research and development activity.

Penny Corp.has never previously restructured its operations and believes that it can return to profitability within two years based on its current research and development activity.

Required:

1.Discuss whether or not you would eliminate the restructuring charge from the 2010 income statement of Penny Corp.when using earnings to forecast future profitability.

2.Penny Corp.'s restructuring charges cover a wide range of different cost categories,identify those that entail a cash payment and those that do not require a cash payment.For those charges not requiring a cash payment how would they be treated in the Statement of Cash Flows?

Correct Answer:

Verified

Q43: The _ is the date of closing

Q46: Earnings are informative if they signal the

Q48: On September 1,2012,Ramos Inc.approved a plan to

Q49: Under current GAAP unrealized gains and losses

Q54: Some firms attempt to maximize the amount

Q58: _ represents the concept of being able

Q59: U.S.GAAP requires that changes in estimates be

Q67: Healy and Wahlen state that one type

Q73: Many users of financial statements believe that

Q75: Healy and Wahlen state that one type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents