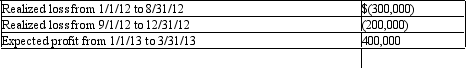

On September 1,2012,Ramos Inc.approved a plan to dispose of a segment of its business.Ramos expected that the sale would occur on March 31,2013,at an estimated gain of $350,000.The segment had actual and estimated operating profits (losses as follows):

Assume a marginal tax rate of 30%.

Assume a marginal tax rate of 30%.

Required:

In its 2012 income statement,what should Ramos report as profit or loss from discontinued operations (net of tax effects)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: The _ is the date of closing

Q46: Penny Corp.manufactures telecommunication equipment and has been

Q49: Under current GAAP unrealized gains and losses

Q51: An extraordinary gain or loss is unusual

Q54: Some firms attempt to maximize the amount

Q58: _ represents the concept of being able

Q59: U.S.GAAP requires that changes in estimates be

Q66: Many times an analyst will have to

Q67: Healy and Wahlen state that one type

Q75: Healy and Wahlen state that one type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents