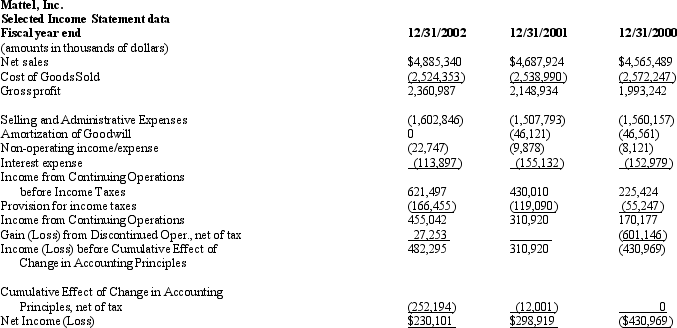

Mattel,Inc.designs,manufactures and markets various toy products worldwide through sales to retailers and directly to consumers.Among the company's many products are Barbie,GI Joe,and American Girls.Below is an income statement for Mattel for years 2002,2001 and 2000.Notes to the financial statements reveal the following information.

1.Discontinued Operations - In 1999 Mattel merged with Learning Company,with Mattel being the surviving company.The Learning Company,which produced consumer software,represented a separate line of business for Mattel.In 2000 Mattel's Board of Directors committed to dispose of the Learning Company and its consumer software operations.In 2000 the Learning Company was reported as a discontinued operation and the company was sold to Gores Technology on October 18,2000.

In 2002 Mattel received a contractual payment from Gores Technology based on the sale of assets of Learning Company and other liquidation events.

2.Accounting Change - In 2001 Mattel changed the manner in which it accounted for derivative instruments consistent with the issuance of SFAS No.133 Accounting for Derivative Instruments and hedging Activities.The change resulted in Mattel recording a one-time adjustment of $12 million.

3.Accounting Change - In 2002 the FASB issued SFAS No.142 Goodwill and Other Intangible Assets.The standard requires that management estimate the value of its goodwill and,if necessary,record an impairment charge.Consistent with SFAS No.142 Mattel recorded a one-time adjustment of $252.2 million,net of tax,as the cumulative effect of the change in accounting principle.

Required:

Required:

a.Discuss whether or not you would adjust for each of the following items when using earnings to forecast the future profitability of Mattel:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: When evaluating the quality of accounting information

Q50: When evaluating the quality of accounting information

Q54: First Bank recognized an extraordinary loss from

Q57: Banks Corp.reported net income of $390,000 in

Q59: Achieving comparability in financial reporting is important

Q60: Creighton Corp.,a textile manufacturer,reported net income of

Q61: Motor Corporation's income statements for the years

Q63: A company may try to paint a

Q65: On July 15,2009 Time Services decided to

Q71: On November 15,2012,Jacobs Co.sold a segment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents