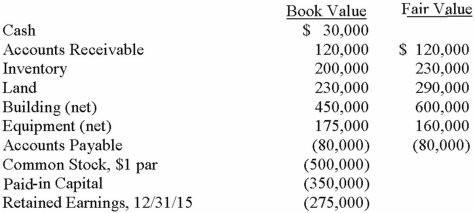

On January 1, 2013, Chester Inc. acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock. On January 1, 2013, Chester's voting common stock had a fair value of $40 per share. Festus' voting common shares were selling for $6.50 per share. Festus' balances on the acquisition date, just prior to acquisition are listed below.  Required:

Required:

Compute the value of the Goodwill account on the date of acquisition, 1/1/15.

Correct Answer:

Verified

Q92: Fine Co. issued its common stock in

Q101: Salem Co. had the following account

Q104: The following are preliminary financial statements for

Q104: How are direct combination costs, contingent consideration,

Q106: Describe the accounting for direct costs, indirect

Q108: The financial statements for Jode Inc. and

Q109: The following are preliminary financial statements for

Q110: How is contingent consideration accounted for in

Q111: How are bargain purchases accounted for in

Q114: What is the difference in consolidated results

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents