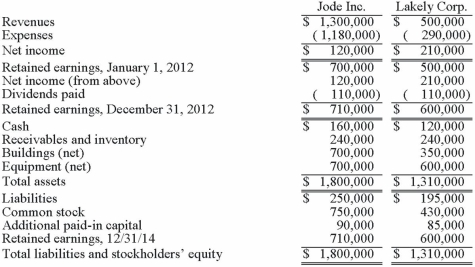

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2012, follow. Lakely's buildings were undervalued on its financial records by $60,000.  On December 31, 2012, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

On December 31, 2012, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Prepare the journal entries to record (1) the issuance of stock by Jode and (2) the payment of the combination costs.

Correct Answer:

Verified

Entry One - To record the is...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Fine Co. issued its common stock in

Q104: How are direct combination costs, contingent consideration,

Q104: The following are preliminary financial statements for

Q106: On January 1, 2013, Chester Inc. acquired

Q106: Describe the accounting for direct costs, indirect

Q109: The following are preliminary financial statements for

Q111: How are bargain purchases accounted for in

Q112: Salem Co. had the following account

Q113: The financial statements for Jode Inc. and

Q114: What is the difference in consolidated results

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents