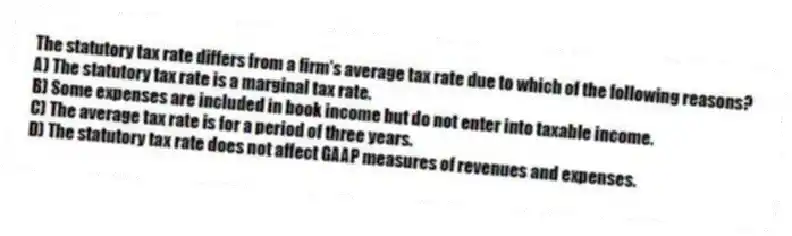

The statutory tax rate differs from a firm's average tax rate due to which of the following reasons?

A) The statutory tax rate is a marginal tax rate.

B) Some expenses are included in book income but do not enter into taxable income.

C) The average tax rate is for a period of three years.

D) The statutory tax rate does not affect GAAP measures of revenues and expenses.

Correct Answer:

Verified

Q29: Ramos Company

Ramos Company included the following

Q30: Adjustments for dilutive securities and the adjustment

Q31: Multiples of EPS to value firms are

Q32: Sustainable earnings represent:

A) the level of earnings

Q33: Which of the following would be considered

Q35: Hall and Porter argue that firms have

Q36: The profit margin for ROA indicates the

Q37: Which of the following is the primary

Q38: Extreme Sports Company and All Sports

Q39: Ramos Company

Ramos Company included the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents