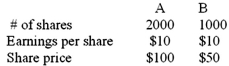

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is,after the merger,there are 2500 shares of A outstanding) .If investors are aware that there are no economic gains from the merger,what is the price-earnings ratio of A's stock after the merger?

A) 7.5

B) 8.3

C) 10.0

Correct Answer:

Verified

Q1: The following are sensible motives for mergers

Q2: The following are sensible reasons for mergers:

I.economies

Q6: Firm A has a value of $100

Q8: Google's acquisition of Motorola Mobility is an

Q8: The market for corporate control includes

I.mergers;

II.spin-offs and

Q10: Which of the following actions by an

Q11: Firm A has a value of $200

Q13: The merger of two similar pharmaceutical firms

Q19: Companies A and B are valued as

Q20: Firm A has a value of $100

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents