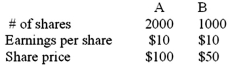

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is,after the merger,there are 2500 shares of A outstanding) .Suppose that the merger really does increase the value of the combined firms by $20,000..What is the cost of the merger?

A) zero

B) $2,000

C) $8,000

D) $4,000

Correct Answer:

Verified

Q2: The following are sensible reasons for mergers:

I.economies

Q6: Firm A has a value of $100

Q8: The market for corporate control includes

I.mergers;

II.spin-offs and

Q10: The following are sensible motives for mergers:

I.prevent

Q14: Companies A and B are valued as

Q20: Firm A has a value of $100

Q21: Following an acquisition,the acquiring firm's balance sheet

Q22: The following data on a merger

Q24: The following data on a merger

Q36: Antitrust law can be enforced by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents