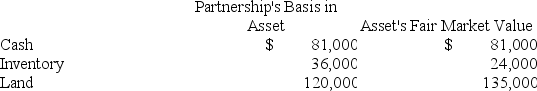

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $20,000.On that date,she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Lola is a 35% partner in the

Q85: Esther and Elizabeth are equal partners in

Q89: Katrina is a one-third partner in the

Q92: Tatia's basis in her TRQ partnership interest

Q93: Lola is a 35% partner in the

Q97: Locke is a 50% partner in the

Q97: Katrina is a one-third partner in the

Q98: Marty is a 40% owner of MB

Q99: Daniel's basis in the DAT Partnership is

Q106: Tyson, a one-quarter partner in the TF

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents