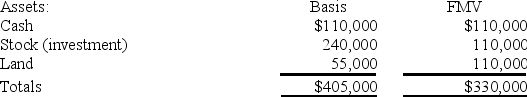

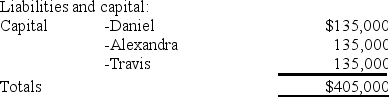

Daniel's basis in the DAT Partnership is $135,000.DAT distributes its land to Daniel in complete liquidation of his partnership interest.DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place,what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place,what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Lola is a 35% partner in the

Q85: Esther and Elizabeth are equal partners in

Q92: Tatia's basis in her TRQ partnership interest

Q93: Lola is a 35% partner in the

Q94: Doris owns a 1/3 capital and profits

Q97: Katrina is a one-third partner in the

Q97: Locke is a 50% partner in the

Q98: Marty is a 40% owner of MB

Q99: Scott is a 50% partner in the

Q106: Tyson, a one-quarter partner in the TF

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents