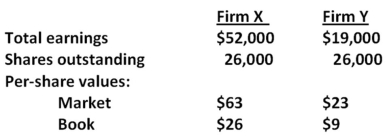

Consider the following premerger information about Firm X and Firm Y:  Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

A) $1,274,000

B) $1,316,000

C) $1,352,000

D) $1,422,000

E) $1,427,000

Correct Answer:

Verified

Q65: Aardvark Enterprises has agreed to be acquired

Q75: Assume the following balance sheets are stated

Q76: Hanover Tires is being acquired by Better

Q77: Dressler,Inc.,is planning on merging with Weston Foods.Dressler

Q78: George's Equipment is planning on merging with

Q81: Defensive merger tactics are designed to thwart

Q82: Consider the following premerger information about a

Q83: Empirical evidence indicates that the returns to

Q84: Silver Enterprises has acquired All Gold Mining

Q85: Firms can frequently create synergy by merging

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents