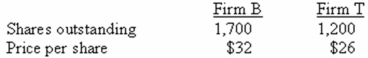

Consider the following premerger information about a bidding firm (Firm B) and a target firm (Firm T) .Assume that neither firm has any debt outstanding.  Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $2,500.What is the NPV of the merger assuming that Firm T is willing to be acquired for $28 per share in cash?

Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $2,500.What is the NPV of the merger assuming that Firm T is willing to be acquired for $28 per share in cash?

A) $100

B) $400

C) $1,800

D) $2,200

E) $2,600

Correct Answer:

Verified

Q65: Aardvark Enterprises has agreed to be acquired

Q77: Dressler,Inc.,is planning on merging with Weston Foods.Dressler

Q78: George's Equipment is planning on merging with

Q80: Consider the following premerger information about Firm

Q81: Defensive merger tactics are designed to thwart

Q83: Empirical evidence indicates that the returns to

Q84: Silver Enterprises has acquired All Gold Mining

Q85: Firms can frequently create synergy by merging

Q86: Penn Corp.is analyzing the possible acquisition of

Q87: Consider the following premerger information about Firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents