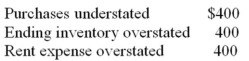

The errors listed below occurred in 20x3 but were not discovered until much later in 20x4. The accounting period ends December 31.  What net effect did these errors have on 20x3 pre-tax income?

What net effect did these errors have on 20x3 pre-tax income?

A) Overstated by $400

B) Overstated by $800

C) Understated by $400

D) Understated by $1,200

Correct Answer:

Verified

Q115: The records of CTC reported rent expense

Q116: Reported income for CXC was incorrect due

Q117: An asset that costs $4,000 on January

Q118: The ending inventory of XZW was overstated

Q119: A plant asset was purchased for $19,000

Q121: KEC has a machine that cost $75,000

Q122: The records of CDF reflected the following

Q124: Listed below are a number of errors.Indicate

Q125: An asset cost $12,000 when acquired and

Q148: On January 1, 2014, Ryan Ltd.purchased equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents