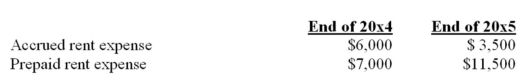

The records of CTC reported rent expense for 20x5 (paid in cash during 20x5) of $53,500.An audit revealed that the following accrued and prepaid amounts were not recorded in the adjusting entries for 20x4 and 20x5:  What amount should have been reported for 20x5 rent expense?

What amount should have been reported for 20x5 rent expense?

A) $46,500

B) $53,500

C) $60,500

D) $64,000

Correct Answer:

Verified

Q110: MGC Inc.reported $50,000 of net income for

Q111: A change in the salvage value of

Q112: GXC Inc.committed the following errors during 20x1,its

Q113: At the beginning of the current year,a

Q114: Which of the following changes would be

Q116: Reported income for CXC was incorrect due

Q117: An asset that costs $4,000 on January

Q118: The ending inventory of XZW was overstated

Q119: A plant asset was purchased for $19,000

Q120: The errors listed below occurred in 20x3

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents