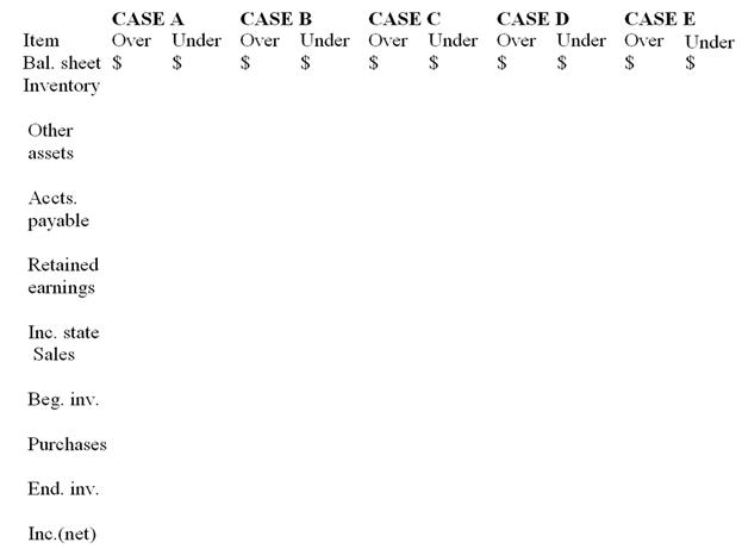

Following are five separate and completely independent cases:

CASE A: A $700 item was excluded incorrectly from the ending inventory; the related purchase was not recorded.

CASE B: A $200 item was included incorrectly in the ending inventory; the related purchase was recorded.

CASE C: A $900 item was included incorrectly in the ending inventory; the related purchase was not recorded.

CASE D: A $500 item was excluded incorrectly from ending inventory; the related purchase was recorded.

CASE E: The beginning inventory was Overstated $400.

Enter dollar amounts where appropriate in the following tabulation to indicate the effect on the financial statements of each of the items given above (disregard income tax).

Correct Answer:

Verified

Q145: Information for a firm making an accounting

Q146: AME did not account properly for the

Q147: MKC is being audited for the years

Q148: The following errors were discovered in the

Q149: Indicate how the following errors would affect

Q150: On January 1,20x1,CR purchased a special machine

Q152: Depreciation expense for the most recent fiscal

Q153: Complete the following tabulation by inserting in

Q154: Give the correct response to each of

Q156: On January 1, 20x3; a company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents