A company wishes to finance a long-term construction project and in doing so,capitalize the related interest expense.The company requires $2 million in financing.

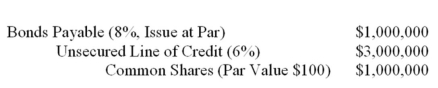

The company currently has the following debt and equity items on its December 31st,2019 Balance Sheet:  There are 10,000 common shares outstanding which pay an annual dividend of $5 per share.The company can borrow a maximum of $5 million on its unsecured line of credit.

There are 10,000 common shares outstanding which pay an annual dividend of $5 per share.The company can borrow a maximum of $5 million on its unsecured line of credit.

The company's bank has indicated its willingness to extend an additional credit facility in the amount of $1.5 million at an annual rate of 5% as of March 31st,Year 6.These amounts remained outstanding throughout Year 6.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: RX issued $1,000,000,10% bonds payable (interest payable

Q61: ABC Inc.issued $10,000,000 worth of bonds on

Q62: It is often necessary to compute the

Q62: ABC Inc.borrowed funds from its bank.Details are

Q66: GHI Inc.issued $5,000,000 worth of bonds on

Q67: AB owes a $100,000, 8%, five-year note

Q69: On September 1, 2015, a company signed

Q69: X owed a debt dated January 1,2020,amounting

Q72: On April 1, 2020, the DEF sold

Q74: On July 1, 2012, RC sold two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents