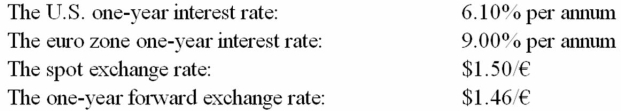

Suppose that Boeing Corporation exported a Boeing 747 to Lufthansa and billed €10 million payable in one year.The money market interest rates and foreign exchange rates are given as follows:  Assume that Boeing sells a currency forward contract of €10 million for delivery in one year,in exchange for a predetermined amount of U.S.dollar.Which of the following is (or are) true? On the maturity date of the contract Boeing will:

Assume that Boeing sells a currency forward contract of €10 million for delivery in one year,in exchange for a predetermined amount of U.S.dollar.Which of the following is (or are) true? On the maturity date of the contract Boeing will:

(i) have to deliver €10 million to the bank (the counterparty of the forward contract)

(ii) take delivery of $14.6 million

(iii) have a zero net pound exposure

(iv) have a profit,or a loss,depending on the future changes in the exchange rate,from this British sale

A) (i) and (iv)

B) (ii) and (iv)

C) (ii) , (iii) , and (iv)

D) (i) , (ii) , and (iii)

Correct Answer:

Verified

Q2: A stock market investor would pay attention

Q3: Suppose that Boeing Corporation exported a Boeing

Q4: If you own a foreign currency denominated

Q4: Your firm is a U.K.-based exporter of

Q4: If you have a long position in

Q5: With any hedge,

A)your losses on one side

Q11: Transaction exposure is defined as

A)the sensitivity of

Q12: Your firm has a British customer that

Q15: Since a corporation can hedge exchange rate

Q17: If you owe a foreign currency denominated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents