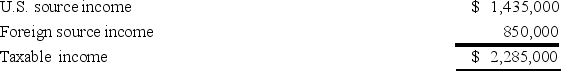

Koscil Inc.had the following taxable income.Corporate tax rate schedule.

Koscil paid $315,000 foreign income tax.Compute its U.S.income tax liability.

Koscil paid $315,000 foreign income tax.Compute its U.S.income tax liability.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Which of the following statements about subpart

Q96: If a U.S.multinational corporation incurs start-up losses

Q96: In which of the following cases are

Q98: Chester,Inc.,a U.S.multinational,earns income in three foreign countries.Country

Q100: Orchid Inc.,a U.S.multinational with a 34% marginal

Q102: Pogo,Inc.,which has a 34 percent marginal tax

Q103: Columbus Inc.owns 100 percent of the stock

Q104: Origami does business in states X and

Q106: DFJ, a Missouri corporation, owns 55% of

Q106: Sunny,a California corporation,earned the following income this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents