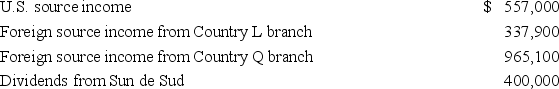

Sunny,a California corporation,earned the following income this year.

Sunny owns 100% of Sun de Sud,a foreign corporation operating a business in Country M and paying foreign income tax at a 50% rate.Sunny paid $124,000 foreign income tax to Country L,$203,000 income tax to Country Q,and no foreign withholding tax on its Sun de Sud dividends.Assuming a 34% tax rate,compute Sunny's U.S.tax.

Sunny owns 100% of Sun de Sud,a foreign corporation operating a business in Country M and paying foreign income tax at a 50% rate.Sunny paid $124,000 foreign income tax to Country L,$203,000 income tax to Country Q,and no foreign withholding tax on its Sun de Sud dividends.Assuming a 34% tax rate,compute Sunny's U.S.tax.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Which of the following statements about subpart

Q96: If a U.S.multinational corporation incurs start-up losses

Q98: Chester,Inc.,a U.S.multinational,earns income in three foreign countries.Country

Q100: Orchid Inc.,a U.S.multinational with a 34% marginal

Q101: Koscil Inc.had the following taxable income.Corporate tax

Q102: Pogo,Inc.,which has a 34 percent marginal tax

Q103: Columbus Inc.owns 100 percent of the stock

Q103: This year,Plateau,Inc.'s before-tax income was $4,765,000.Plateau paid

Q104: Origami does business in states X and

Q106: DFJ, a Missouri corporation, owns 55% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents