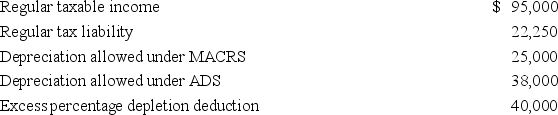

Loraine Manufacturing,Inc.reported the following for the current tax year:

What is Loraine Manufacturing's alternative minimum taxable income before any AMT exemption?

What is Loraine Manufacturing's alternative minimum taxable income before any AMT exemption?

A) $55,000

B) $135,000

C) $122,000

D) $82,000

Correct Answer:

Verified

Q82: In determining the incidence of the corporate

Q93: Pocahontas,Inc.had the following results for its first

Q94: Sunny Vale Co.reported the following for the

Q95: For tax years beginning after December 31,2015,which

Q98: Which of the following statements regarding the

Q99: Which of the following could cause a

Q100: Joanna has a 35% marginal tax rate

Q101: Gosling,Inc.,a calendar year,accrual basis corporation,reported $756,000 net

Q102: Franton Co.,a calendar year,accrual basis corporation,reported $2,076,000

Q103: Tropical Corporation was formed in 2015.For 2015

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents