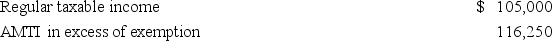

Sunny Vale Co.reported the following for the current tax year: Corporate tax rate schedule.  Compute Sunny Vale's total income tax liability.

Compute Sunny Vale's total income tax liability.

A) $23,250

B) $950

C) $24,200

D) $47,450

Correct Answer:

Verified

Q82: In determining the incidence of the corporate

Q89: Corporation F owns 95 percent of the

Q90: Harmon,Inc.was incorporated and began business on January

Q91: Assuming that the corporation has a 34%

Q92: Grumond was incorporated on January 1,2010,and adopted

Q93: Pocahontas,Inc.had the following results for its first

Q95: For tax years beginning after December 31,2015,which

Q98: Which of the following statements regarding the

Q98: Loraine Manufacturing,Inc.reported the following for the current

Q99: Which of the following could cause a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents