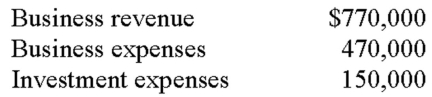

Alex,Ellen and Nicolas are equal partners in a local restaurant.The restaurant reports the following items for the current year:  Each partner receives a Schedule K-1 with one-third of the preceding items reported to him/her.How must each individual report these results on his/her Form 1040?

Each partner receives a Schedule K-1 with one-third of the preceding items reported to him/her.How must each individual report these results on his/her Form 1040?

A) $100,000 income on Schedule E; $50,000 investment expense on Schedule A

B) $257,667 income on Schedule E; $50,000 investment expense on Schedule A

C) $300,000 income on Schedule E; $50,000 investment expense on Schedule A

D) $300,000 income on Schedule E; $150,000 investment expense on Schedule A

Correct Answer:

Verified

Q66: Jeremy and Gladys own a cabin in

Q67: Which of the following statements is true

Q68: Samantha is a full-time author and recently

Q69: Reggie and Bebe own an apartment building

Q72: Royalties can be earned from allowing others

Q74: Darius and Chantal own a cabin in

Q75: When royalties are paid,at the end of

Q76: Owen and Jessica own and operate an

Q78: On June 1st of the current year,Kayla

Q79: On June 1st of the current year,Nancy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents