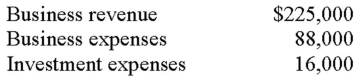

Owen and Jessica own and operate an S corporation.Each is a 50% owner.The business reports the following results:  How do Owen and Jessica report these items for tax purposes?

How do Owen and Jessica report these items for tax purposes?

A) $68,500 income on Schedule E; $16,000 investment expense on Schedule D

B) $68,500 income on Schedule E; $8,000 investment expense on Schedule A

C) $137,000 income on Schedule E; $88,000 investment expense on Schedule A

D) $225,000 income on Schedule E; $16,000 investment expense on Schedule A

Correct Answer:

Verified

Q61: Which of the following entity(ies)is(are)considered flow-through?

A)C corporation

B)Sole

Q63: Royalties can be earned from allowing others

Q67: Which of the following statements is true

Q71: Alex,Ellen and Nicolas are equal partners in

Q72: Royalties can be earned from allowing others

Q73: Jackson owns a condominium in Las Vegas,

Q75: When royalties are paid,at the end of

Q78: On June 1st of the current year,Kayla

Q79: Stephen and Joy own a duplex in

Q81: Lori and Donald own a condominium in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents