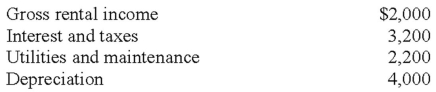

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% (based on the IRS method) .They had the following income and expenses for the year (before any allocation) :  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

A) $0.

B) $3,350 loss.

C) $7,400 loss.

D) $9,000 loss.

Correct Answer:

Verified

Q61: Which of the following entity(ies)is(are)considered flow-through?

A)C corporation

B)Sole

Q63: Royalties can be earned from allowing others

Q73: Jackson owns a condominium in Las Vegas,

Q76: Owen and Jessica own and operate an

Q79: Stephen and Joy own a duplex in

Q85: Royalties can be earned from allowing others

Q86: Katie and Mike own a home in

Q111: When reporting the income and expenses of

Q113: Which of the following is not considered

Q115: What are the criteria that determine an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents