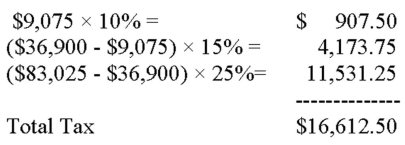

Xavier is single and has taxable income of $83,025 that is taxed as follows:  His average tax rate is:

His average tax rate is:

A) 10%.

B) 15%.

C) 20%.

D) 25%.

Correct Answer:

Verified

Q102: A state or local sales tax is

Q108: Which of the following types of Regulations

Q117: Which of the following statements is correct?

A)The

Q117: The tax liability for a married couple

Q119: Xavier is single and has taxable income

Q122: What is a Private Letter Ruling (PLR)?

Q126: What is the definition of a proportional

Q128: There are six criteria a taxpayer must

Q131: What is the definition of a regressive

Q133: Describe the legislative process for enacting a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents