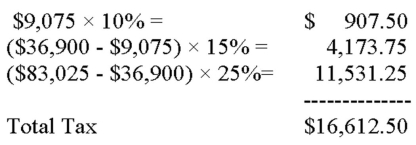

Xavier is single and has taxable income of $83,025 that is taxed as follows:  His marginal tax rate is:

His marginal tax rate is:

A) 10%.

B) 15%.

C) 20%.

D) 25%.

Correct Answer:

Verified

Q102: A state or local sales tax is

Q108: Which of the following types of Regulations

Q114: Which of the following statements is correct?

A)

Q117: Which of the following statements is correct?

A)The

Q117: The tax liability for a married couple

Q120: Xavier is single and has taxable income

Q122: What is a Private Letter Ruling (PLR)?

Q126: What is the definition of a proportional

Q128: There are six criteria a taxpayer must

Q131: What is the definition of a regressive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents