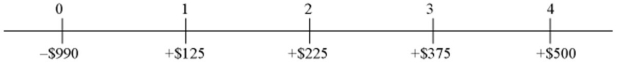

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. What is the levered after-tax incremental cash flow for year 2?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. What is the levered after-tax incremental cash flow for year 2?

A) $185,796,000

B) $215,152,000

C) $267,952,000

D) $284,848,000

Correct Answer:

Verified

Q28: Your firm's existing bonds trade with a

Q29: Consider a project of the Cornell Haul

Q30: Your firm is in the 34 percent

Q31: Consider a project of the Cornell Haul

Q32: Consider a project of the Cornell Haul

Q34: Consider a project of the Cornell Haul

Q35: The required return on equity for a

Q36: What proportion of the firm is financed

Q37: The required return on equity for an

Q38: Consider a project of the Cornell Haul

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents