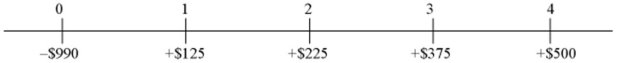

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of this project to an all-equity firm?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of this project to an all-equity firm?

A) −$46,502,288.10

B) $12,494,643.75

C) $36,580,767.55

D) −$67,163,445.12

Correct Answer:

Verified

Q33: Consider a project of the Cornell Haul

Q34: Consider a project of the Cornell Haul

Q35: The required return on equity for a

Q36: What proportion of the firm is financed

Q37: The required return on equity for an

Q39: In the APV model

A)interest tax shields are

Q40: Consider a project of the Cornell Haul

Q41: What is the expected return on equity

Q42: The ABC Company,a U.S.-based MNC,plans to establish

Q43: Assume that XYZ Corporation is a leveraged

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents