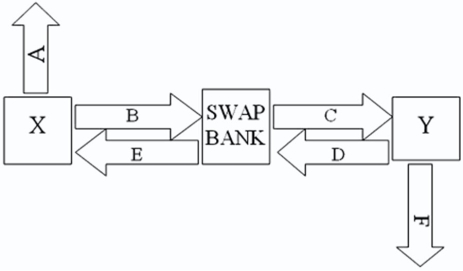

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent?10.45 percent against LIBOR flat.  Assume both X and Y agree to the swap bank's terms.Fill in the values for A,B,C,D,E,& F on the diagram.

Assume both X and Y agree to the swap bank's terms.Fill in the values for A,B,C,D,E,& F on the diagram.

A) A = LIBOR; B = 10.45%; C = 10.05%; D = LIBOR; E = LIBOR; F = 12%

B) A = 10%; B = 10.45%; C = 10.05%; D = LIBOR; E = LIBOR; F = LIBOR + 1½%

C) A = 10%; B = 10.45%; C = LIBOR; D = LIBOR; E = 10.05%; F = LIBOR + 1½%

D) A = 10%; B = LIBOR; C = LIBOR; D = 10.45%; E = 10.05%; F = LIBOR + 1½%

Correct Answer:

Verified

Q13: Suppose the quote for a five-year swap

Q14: The primary reasons for a counterparty to

Q15: Company X wants to borrow $10,000,000

Q16: A swap bank has identified two companies

Q17: Suppose the quote for a five-year swap

Q19: Company X and company Y have mirror-image

Q20: In the swap market,which position potentially carries

Q21: Company X wants to borrow $10,000,000

Q22: Company X wants to borrow $10,000,000

Q23: Pricing a currency swap after inception involves

A)finding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents