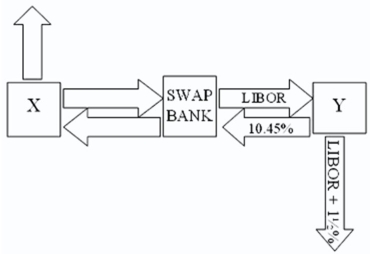

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below.

A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent -10.45 percent against LIBOR flat.

Assume company Y has agreed,but company X will only agree to the swap if the bank offers better terms.

What are the absolute best terms the bank can offer X,given that it already booked Y?

A) 10.45% ?10.45% against LIBOR flat.

B) 10.45%?10.05% against LIBOR flat.

C) 10.50%?10.50% against LIBOR flat.

D) none of the options

Correct Answer:

Verified

Q16: A swap bank has identified two companies

Q17: Suppose the quote for a five-year swap

Q18: Company X wants to borrow $10,000,000

Q19: Company X and company Y have mirror-image

Q20: In the swap market,which position potentially carries

Q22: Company X wants to borrow $10,000,000

Q23: Pricing a currency swap after inception involves

A)finding

Q24: Consider the dollar- and euro-based borrowing

Q25: Company X wants to borrow $10,000,000

Q26: In a currency swap,

A)it may be the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents