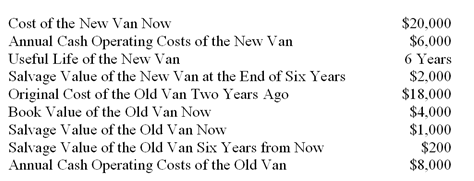

Layton Company is replacing an old delivery van with a new van. The following data relate to this investment decision:

The old van is in Class 10 with a maximum CCA rate of 30% and will last for six more years. The new van is also in Class 10 with a maximum CCA rate of 30%. The income tax rate is 40%, and the company's after-tax cost of capital is 10%.

-What is the value of the incremental UCC (the "C" in the PV CCA formula) used in the calculation for the present value of CCA tax savings?

A) $20,000

B) $19,000

C) $18,000

Correct Answer:

Verified

Q122: Layton Company is replacing an old delivery

Q123: The Morgan Company has been awarded a

Q124: The Morgan Company has been awarded a

Q125: Layton Company is replacing an old

Q125: A piece of equipment, acquired in Year

Q128: A piece of equipment, acquired in Year

Q128: Eureka Company is considering replacing an

Q129: The Morgan Company has been awarded a

Q132: Manti Company purchased a new machine on

Q137: The Morgan Company has been awarded

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents