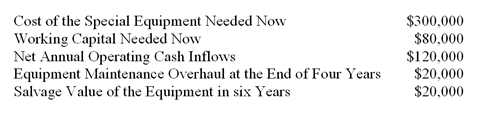

The Morgan Company has been awarded a six-year contract to provide repair service to a commercial bus line. Morgan Company has gathered the following data associated with the items needed for this contract:

The special equipment is in Class 7 with a maximum 15% CCA rate. The income tax rate is 40%, and Morgan's after-tax cost of capital is 14%. At the end of six years, the working capital will be released for use elsewhere.

-The present value of the total after-tax net cash inflows (outflows) ,excluding any CCA tax shield,in Year 4 is closest to which of the following?

A) ($7,105) .

B) $23,684.

C) $35,520.

D) $71,052.

Correct Answer:

Verified

Q119: Payson Company bought $40,000 worth of office

Q120: Lambert Manufacturing has $60,000 to invest in

Q121: Eureka Company is considering replacing an old

Q122: Layton Company is replacing an old delivery

Q123: The Morgan Company has been awarded a

Q125: A piece of equipment, acquired in Year

Q125: Layton Company is replacing an old

Q127: Layton Company is replacing an old delivery

Q128: A piece of equipment, acquired in Year

Q129: The Morgan Company has been awarded a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents