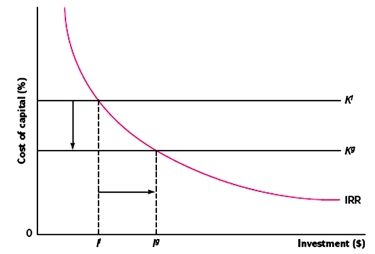

Suppose that the firm's cost of capital can be reduced from Kl under the local capital structure to Kg under an internationalized capital structure. The take-away lesson from the graph is that

A) The firm can then increase its profitable investment outlay from Il to Ig, contributing to the firm's value.

B) A reduced cost of capital increases the firm's value not only through increased investments in new projects but also through revaluation of the cash flows from existing projects.

C) Kl and Kg represent, respectively, the cost of capital under local and international capital structures; IRR represents the internal rate of return on investment projects; Il and Ig represent the optimal investment outlays under the alternative capital structures.

D) All of the above

Correct Answer:

Verified

Q65: For most countries and most firms, the

Q66: Studies suggest that international capital markets are

Q67: Compute the domestic country beta of Stansfield

Q68: Assume that XYZ Corporation is a leveraged

Q69: Suppose the domestic U.S. beta of IBM

Q71: Suppose that the British stock market is

Q72: In the real world, does the cost

Q74: In the Capital Asset Pricing Model (CAPM),

Q75: The firm's tax rate is 34%. The

Q76: The following is an outline of certain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents