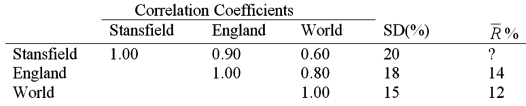

Suppose that the British stock market is integrated with the rest of the world and Stansfield Company has made its shares tradable internationally via cross-listing on the NYSE. Using the CAPM and a risk-free rate of 5%, estimate the equity cost of capital for Stansfield.

A) 12%

B) 10.60%

C) 6.60%

D) None of the above

Correct Answer:

Verified

Q66: Studies suggest that international capital markets are

Q67: Compute the domestic country beta of Stansfield

Q68: Assume that XYZ Corporation is a leveraged

Q69: Suppose the domestic U.S. beta of IBM

Q70: Suppose that the firm's cost of capital

Q72: In the real world, does the cost

Q74: In the Capital Asset Pricing Model (CAPM),

Q75: The firm's tax rate is 34%. The

Q76: The following is an outline of certain

Q76: Assume that XYZ Corporation is a levered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents