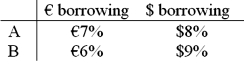

Consider the dollar- and euro-based borrowing opportunities of companies A and

A) Yes, QSD = [€7% - €6% × $2.00/€1.00 - ($8% - $9%) = $2% + $1% = $3%

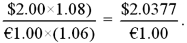

B)  A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00 and the one-year forward rate is given by IRP as:

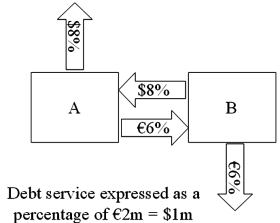

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00 and the one-year forward rate is given by IRP as:  Suppose they agree to the swap shown at right. Is this mutually beneficial swap equally fair to both parties?

Suppose they agree to the swap shown at right. Is this mutually beneficial swap equally fair to both parties?

B) No, company A borrows at 6% in euro but company B borrows at 8% in dollars

C) Yes, A will be better off by €1% on €1m; B by 1% on $2m and $2.00 = €1.00

D) No, company A saves 1% in euro but company B saves only 1% in dollars when the spot exchange rate is $2.00 = €1.00-A is twice as better off as B

Correct Answer:

Verified

Q12: Which combination of the following statements is

Q16: In the swap market, which position potentially

Q17: The size of the swap market is

A)measured

Q18: Suppose the quote for a five-year swap

Q20: Company X and company Y have mirror-image

Q22: Pricing an interest-only single currency swap after

Q23: Consider the dollar- and euro-based borrowing opportunities

Q24: A is a U.S.-based MNC with AAA

Q25: Company X wants to borrow $10,000,000 floating

Q26: Compute the payments due in the FIRST

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents