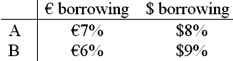

A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00, a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR:  The firms external borrowing opportunities are:

The firms external borrowing opportunities are:

A) Firm A does 2 swaps with the swap bank, $ at bid and € at ask. Firm B does 2 swaps with the swap bank, $ at ask and € at bid. Firms A and B would each save 90bp and the swap bank would earn 20bp.

B) There is no mutually beneficial swap at these prices.

C) Firm A does 2 swaps with the swap bank, $ at ask and € at bid. Firm B does 2 swaps with the swap bank, $ at bid and € at ask. Firms A and B would each save 90bp and the swap bank would earn 20bp.

D) None of the above

Correct Answer:

Verified

Q12: Which combination of the following statements is

Q20: Company X and company Y have mirror-image

Q21: Consider the dollar- and euro-based borrowing opportunities

Q22: Pricing an interest-only single currency swap after

Q23: Consider the dollar- and euro-based borrowing opportunities

Q25: Company X wants to borrow $10,000,000 floating

Q26: Compute the payments due in the FIRST

Q27: Company X wants to borrow $10,000,000 floating

Q28: In a currency swap

A)it may be the

Q29: Swaps are said to offer market completeness

A)This

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents