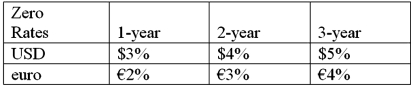

Suppose that you are a swap bank and you notice that interest rates on zero coupon bonds are as shown. Develop the 3-year bid price of a dollar swap quoted against flat USD LIBOR.  In other words, what you be willing to pay in euro against receiving USD LIBOR?

In other words, what you be willing to pay in euro against receiving USD LIBOR?

A) 5%

B) 4%

C) 3%

D) 2%

Correct Answer:

Verified

Q66: Devise a direct swap for A and

Q67: What are the IRP 1-year and 2-year

Q68: Suppose that you are a swap bank

Q69: Come up with a swap (principal +

Q70: Explain how this opportunity affects which swap

Q72: What would be the interest rate?

Q73: Suppose that the swap that you proposed

Q74: Come up with a swap (exchange of

Q75: Explain how firm A could use the

Q76: Suppose that you are a swap bank

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents