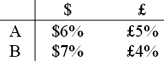

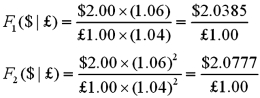

Consider the situation of firm A and firmB. The current exchange rate is $2.00/£ Firm A is a U.S. MNC and wants to borrow £30 million for 2 years. Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings.  The IRP 1-year and 2-year forward exchange rates are

The IRP 1-year and 2-year forward exchange rates are

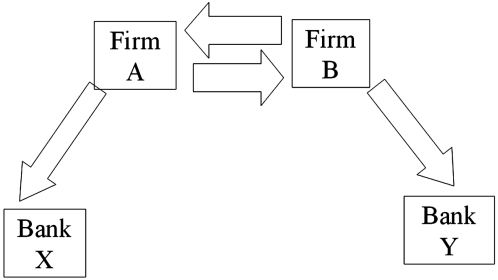

Devise a direct swap for A and B that has no swap bank. Show their external borrowing. Answer the problem in the template provided.

Devise a direct swap for A and B that has no swap bank. Show their external borrowing. Answer the problem in the template provided.

Correct Answer:

Verified

Q70: Explain how this opportunity affects which swap

Q72: What would be the interest rate?

Q72: What would be the interest rate?

Q77: Explain how this opportunity affects which swap

Q85: Explain how firm B could use the

Q93: Explain how firm A could use the

Q94: Consider the borrowing rates for Parties A

Q95: Devise a direct swap for A and

Q97: Explain how firm A could use two

Q99: An interest-only currency swap has a remaining

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents