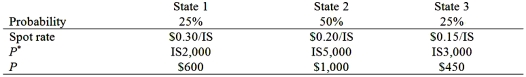

A U.S. firm holds an asset in Israel and faces the following scenario:  where,

where,

P* = Israeli shekel (IS) price of the asset held by the U.S. firm

P = Dollar price of the same asset

-The expected value of the investment in U.S. dollars is:

A) $2,083.33

B) $762.50

C) $6,250.00

D) $6,562.50

Correct Answer:

Verified

Q19: What does it mean to have redenominated

Q34: Operating exposure can be defined as

A)the link

Q38: On the basis of regression Equation

Q40: The "exposure" (i.e. the regression coefficient beta)

Q41: Suppose a U.S. firm has an asset

Q43: A U.S. firm holds an asset in

Q44: Which of the following would be an

Q45: A U.S. firm holds an asset in

Q46: Which of the following would be an

Q47: Suppose a U.S. firm has an asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents