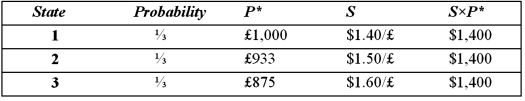

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

A) The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B) The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C) The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D) Since randomness is involved, no hedging is possible.

Correct Answer:

Verified

Q19: What does it mean to have redenominated

Q34: Operating exposure can be defined as

A)the link

Q36: Which of the following are identified by

Q38: On the basis of regression Equation

Q40: The "exposure" (i.e. the regression coefficient beta)

Q42: A U.S. firm holds an asset in

Q43: A U.S. firm holds an asset in

Q44: Which of the following would be an

Q45: A U.S. firm holds an asset in

Q46: Which of the following would be an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents